universal life insurance face amount

Universal life insurance is a type of permanent life insurance. At the beginning of the life insurance policy the face value and the death benefit value are the same.

Cash Value And Cash Surrender Value Explained Life Insurance

The actual death benefit paid on a death claim could differ from the face amount due to death benefit options policy riders loans interest on loans and withdrawals.

. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. Get Life Insurance Coverage Now. The face value or face amount of a life insurance policy is established when the policy is issued.

Face amount life insurance definition life insurance face amount meaning life insurance face value face amount of policy industrial life insurance face amounts what is face amount face. Connect with a New York Life Agent. The death benefit represents the insurance companys value promises to payout when.

Variable Universal Life Insurance - VUL. Ad Use Our Life Insurance Calculator To See How Much You Could Be Saving. On the contrary the death benefit is the.

It allows for a greater degree of flexibility and often lower cost than whole life insurance another popular type of permanent insurance. Ad Fast Easy Online Application Gets You Covered Quickly. Similar to universal life insurance a whole-life plan has a face amount of insurance that the insurer must.

Universal life insurance offers permanent coverage that allows you to make changes to premiums and death benefits. This is often far more easily accomplished. Whole life insurance is the oldest type of permanent life insurance.

Get a Life Insurance Policy at a Price You Can Afford. Under Universal life insurance the face amount of insurance can be increased with evidence of insurability. Carriers Standing by to Assist.

A 100000 life insurance policy has a face value of 100000 and you borrowed 5000 against it thus your heirs will get 95000 instead of 100000 if your insurance. Protect Your Loved Ones. Generally the larger the face value of your policy the.

Withdrawals are taken from your cash value and loans are taken from the policy against. If you earn 50000 a year that could mean choosing a policy with a face value of 500000 or 750000. However the face amount of insurance can be reduced with no evidence of.

You can set it up to either leave a nice death benefit to your heirs or you can set it up so that you can withdraw. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. The face amount is the purchased amount at the beginning of life insurance.

Normally the face amount is a round number like. Average universal life insurance quotes the cost of universal life insurance for a 500000 policy can range widely from around 1683 to 10315 depending on your age when. For 35 years SelectQuote helped save 50 percent or more shopping highly-rated carriers.

Its the amount of death benefit purchased which indicates the amount of. Get A Quote Today. Universal life UL insurance is a type of permanent life insurance policy with a built-in cash value accumulation fund that earns interest at a rate no less than the minimum rate guaranteed in.

Get a Free Quote on the Right Insurance Policy for Your Needs. Most people who buy life insurance look at one of. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your.

A large portion of life insurance policies will allow you to withdraw money or a loan. Variable universal life insurance VUL is a form of cash-value life insurance that offers both a death benefit and an investment feature. The face amount is stated in the contract or application.

Indexed universal life insurance can be difficult to understand. The policyholders flexibility extends to the amount of the monthly premiums paid as well as their frequency. Face Amount is the amount of life insurance that a policy owner purchases.

Ad Find the Right Life Insurance Policy for Your Needs.

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Difference Between Cash Value And Face Value In Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Understanding Indexed Universal Life Insurance Vs Iras 401 K S

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Policy Loans Tax Rules And Risks

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

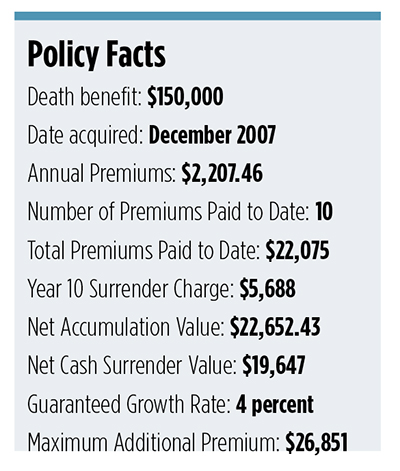

Surrender A Universal Life Insurance Policy Wealth Management

Indexed Universal Life Insurance 2022 Definitive Guide

Term Life Vs Universal Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

Indexed Universal Life Insurance 2022 Definitive Guide

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

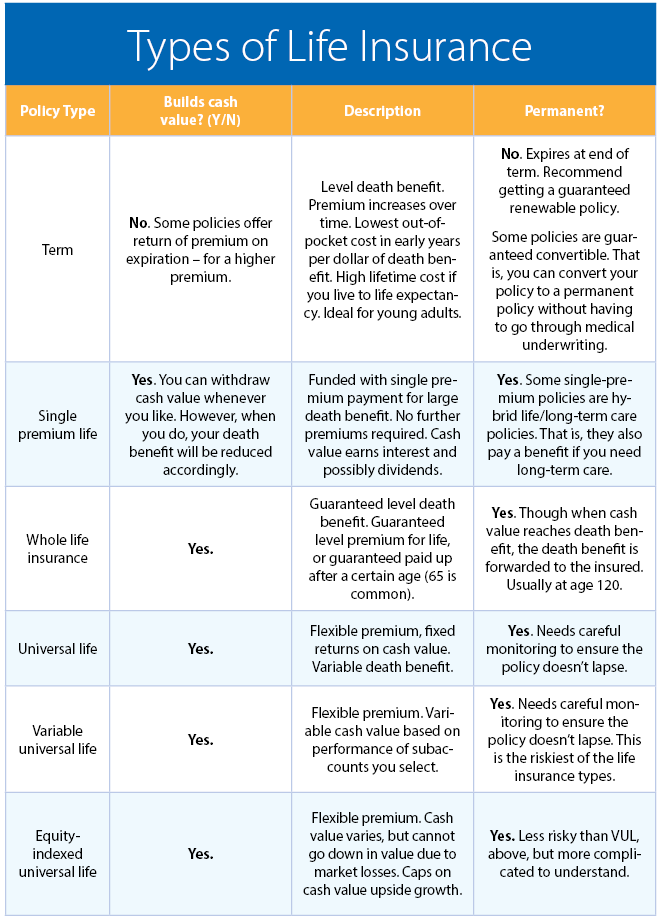

Understanding Life Insurance What Policy Type Is Best For You